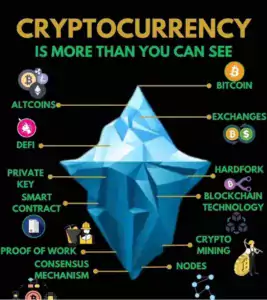

Introduction to Cryptocurrency:

The phrase “cryptocurrency,” which is derived from the words “crypto” (which means secure) and “currency,” refers to a cutting-edge type of digital or virtual currency. Cryptographic methods are used to safeguard transactions, regulate new issuance, and confirm the transfer of assets in cryptocurrencies, in contrast to traditional currencies that are issued by governments and central banks. Investors, technologists, and financial institutions throughout the world have paid close attention to this decentralized character and its potential to upend established financial systems.

History of Cryptocurrency:

The invention of new cryptographic methods in the early 1980s led to the conception of cryptocurrencies. The crucial event, nevertheless, occurred in 2009 with the launch of Bitcoin by an unidentified person using the alias Satoshi Nakamoto. A decentralized, peer-to-peer electronic cash system was described in the Bitcoin whitepaper, ushering in a new era of digital banking. Since then, tens of thousands of alternative cryptocurrencies, or altcoins, have appeared, each with an own set of characteristics and applications.

Key Elements of Cryptocurrency:

1.Blockchain Technology:

Blockchain, a distributed ledger that keeps track of all transactions over a network of computers, is the basis of the majority of cryptocurrencies. Transparency, security, and immutability of transaction data are all guaranteed.

2.Cryptography:

Cryptographic algorithms are used by cryptocurrencies to safeguard transactions, create new units, and regulate the development of new coins.

3.Decentralization:

Cryptocurrencies function on decentralized computer networks, which do not require middlemen, in contrast to conventional currencies managed by centralized authorities.

4.Digital Wallets:

Users use digital wallets, which store the cryptographic keys needed for transactions, to hold and manage cryptocurrency.

5.Mining or Staking:

Cryptocurrencies are created by procedures like mining (Proof of Work) or staking (Proof of Stake), depending on the consensus mechanism, to encourage network participation.

Pro’s of Cryptocurrency:

1.Decentralization and Security:

Cryptographic security methods and decentralized ledgers make cryptocurrencies resistant to fraud and hacking.

2.Financial Inclusion:

Cryptocurrencies, particularly in areas with a weak banking infrastructure, can give unbanked and underbanked populations access to financial services.

3.Fast and Low-Cost Transactions:

In comparison to conventional banking systems, cross-border transactions using cryptocurrency can be completed quickly and for a small fraction of the cost.

4.Innovation and Technological Advancement:

Innovation has been sparked by the underlying blockchain technology in a variety of sectors, including finance, supply chain, healthcare, and more.

Con’s of Cryptocurrency:

1.Volatility:

Cryptocurrencies are infamous for their price volatility, which can cause big value swings in a short amount of time, putting investors at risk.

2.Regulatory Uncertainty:

Uncertainty caused by the changing regulatory environment for cryptocurrencies might hinder uptake and investment for both consumers and enterprises.

3.Lack of Consumer Protections:

Cryptocurrencies do not provide the same level of consumer safeguards as traditional banks, which could result in losses in the event of security breaches or fraud.

4.Environmental Concerns:

Some cryptocurrencies, especially those that use Proof of Work consensus processes, consume a lot of energy, which raises questions about their sustainability.

Read more: Sustainable urban Planning, Designing cities for great future

Decentralized Finance (DeFi):

Here are some key aspects of DeFi:

1.Decentralization:

DeFi uses open blockchain networks, so it is not governed by a single organization. A distributed ledger keeps track of transactions and smart contracts, assuring security and transparency.

2.Open Access:

Anyone with an internet connection and a suitable wallet is welcome to use the DeFi platforms. Global involvement is made possible by this inclusivity, which is especially advantageous for people living in areas with poor access to conventional banking services.

3.Smart Contracts:

Smart contracts, which are pieces of self-executing code placed on a blockchain, are what make up DeFi. These contracts automate financial transactions, doing away with the need for middlemen and lowering related expenses.

4.Financial Services:

Financial services available on DeFi platforms include lending, borrowing, trading, saving, and insurance. With the use of decentralized applications (DApps) on blockchain platforms, users can communicate directly with these services.

5.Lending and Borrowing:

DeFi gives users the option to borrow money by putting up security or to lend their cryptocurrency holdings in exchange for interest. Without the requirement for a regular bank or credit check, this is possible.

6.Tokenization:

Real-world assets can be tokenized via DeFi and represented on a blockchain. This makes assets like real estate, art, and commodities more accessible to a wider audience by enabling fractional ownership.

7.Staking and Yield Farming:

By staking their bitcoin holdings to support the network’s security and operations, users can earn incentives. Yield farming is the practice of supplying liquidity to DeFi platforms in return for incentives or charges.

8.Risk and Reward:

DeFi carries hazards in addition to its creative financial prospects. Despite being secure, smart contracts might still include faults or weaknesses that could lead to losses of money.

9.Regulatory Considerations:

The DeFi regulatory environment is changing, and different jurisdictions may have different legal systems. For DeFi projects to remain viable and legitimate, local restrictions must be followed.

10.Interoperability and Cross-Chain Solutions:

DeFi is not limited to a particular blockchain technology. Numerous initiatives are developing interoperability solutions that enable the seamless transfer of assets and information between various blockchains.

11.Challenges and Scalability:

DeFi struggles with scalability because of high transaction costs and network congestion during peak hours. To solve these problems, scaling techniques like layer-2 protocols and sidechains are being developed.

(By democratizing access to financial services and granting individuals more control over their assets, DeFi marks a paradigm change in the financial sector. The DeFi ecosystem is expected to become more and more important in the larger financial landscape as it continues to develop, offering unique and cutting-edge solutions for both individuals and institutions.)

Read more: Impact of AI on the job market in 2030

Central Bank Digital Currencies (CBDCs):

The central bank or other monetary authority issues and regulates central bank digital currencies (CBDCs), which are digital representations of a country’s traditional currency (such as the dollar, euro, or yen). CBDCs are centralized and often constructed on permissioned ledgers, in contrast to cryptocurrencies like Bitcoin or Ethereum, which are decentralized and run on public blockchains.

Central Bank Digital Currencies (CBDCs) include the following important characteristics:

1.Government Issued:

CBDCs are a recognized type of digital currency backed by the government because they are issued and governed by the central bank.

2.Digital Representation of National Currency:

Each unit of a CBDC is equivalent to one unit of the nation’s old money. One CBDC dollar, for instance, would be worth exactly one physical dollar.

3.Legal Tender:

CBDCs are treated legally the same as actual money. Similar to traditional cash, they can be used for all domestic transactions and payments.

4.Regulated and Controlled:

CBDCs are centralized and under the supervision of the central bank, unlike decentralized cryptocurrencies. This implies that they might be governed by monetary policies and rules established by the government.

5.Privacy and Security:

Different tiers of security and privacy features may be provided by CBDCs. While other implementations would demand identity for specific kinds of transactions, some might permit anonymous transactions.

6.Cross-Border Transactions:

When compared to conventional techniques, CBDCs have the potential to streamline and expedite cross-border transactions.

7.Financial Inclusion:

By giving people who might not have access to traditional banking services access to digital payments and financial services, CBDCs have the potential to improve financial inclusion.

8.Reduced Transaction Costs:

Especially for international transactions that could involve several intermediaries, CBDCs can result in cheaper transaction costs than standard payment methods.

9.Potential for Programmable Money:

CBDCs may support smart contracts, enabling programmable money that can carry out specific conditions automatically when certain criteria are met, depending on how they are implemented.

10.Counteracting Private Cryptocurrencies:

Governments’ response to the emergence of private cryptocurrencies can be observed in CBDCs. Governments can maintain control over the monetary system by offering an official digital currency.

11.Cyber-security and Technical Challenges:

Strong cybersecurity measures are needed to implement a safe CBDC system and guard against potential hacks or assaults. In addition, the technical framework for widespread CBDC adoption must be created.

12.Impact on Commercial Banks:

CBDCs may have an impact on how commercial banks function within the financial system. Direct accounts with the central bank for people and companies could alter the dynamics of the banking industry.

(CBDCs have the potential to change the financial landscape and represent a substantial advancement in the concept of money. It will be interesting to observe how CBDCs are deployed and integrated into current financial systems as nations throughout the world investigate and create their own versions of them.)

Read more: Virtual Reality and its possible application in future.

Non-Fungible Tokens (NFTs):

In the world of digital assets, Non-Fungible Tokens (NFTs) have become a ground-breaking invention. They stand for one-of-a-kind, irrevocable, and provable digital valuables, frequently linked to music, visual or performing arts, digital real estate, and other types of digital property. NFTs are unique and cannot be traded like-for-like, in contrast to cryptocurrencies like Bitcoin and Ethereum, which can be swapped and have an equivalent value.

Non-Fungible Tokens (NFTs) have the following important characteristics:

1.Uniqueness and Indivisibility:

Since each NFT is unique, they cannot be exchanged one for one for any other token. NFTs are the best way to symbolize ownership of distinctive digital or physical assets since blockchain technology ensures their uniqueness.

2.Ownership and Provenance:

NFTs offer a transparent and unchangeable blockchain-based record of ownership and transaction history. This makes it possible to simply confirm who the real owner of an NFT is.

3.Digital Collectibles and Artwork:

NFTs are frequently linked to digital collectibles and art. Artists can tokenize their works so that they can be acquired, exchanged, and owned as digital assets. This has given artists new chances to make money off of their work.

4.Virtual Real Estate and Gaming:

In virtual worlds and gaming settings, NFTs have found use. They may stand in for ownership of digital assets found in these virtual worlds, such as in-game objects, characters, and real estate.

5.Music and Intellectual Property:

Musicians and other producers can tokenize their work to provide purchasers ownership rights. The management and monetization of intellectual property could be revolutionized by NFTs.

6.Interoperability and Standards:

Typically, NFTs are developed on blockchains that support non-fungible standards like ERC-721 and ERC-1155 (Ethereum) or standards that are comparable on other blockchains. These specifications guarantee compatibility and interoperability between various NFT marketplaces and platforms.

7.Smart Contracts and Royalties:

NFTs can include smart contracts, which would allow creators to get a cut of future sales. Even after the initial sale, this brings artists and makers continuing income.

8.Marketplaces and Trading:

NFT exchanges make it easier to buy, sell, and trade non-fungible tokens. By bringing buyers and sellers together, these platforms create a market for digital collectibles and assets.

9.Speculation and Investment:

As investment assets, NFTs have drawn interest. Others are lured to the digital asset’s cultural importance or artistic value, while some buyers make predictions about the potential future value of specific NFTs.

10.Environmental Concerns:

NFTs can have various environmental effects depending on the blockchain they are constructed on. Platforms that employ Proof of Work (PoW) consensus processes, for instance, may consume a lot of energy.

11.Legal and Copyright Considerations:

The usage of NFTs brings up ethical issues with regard to licensing, ownership, and copyright. It is essential to make sure that creators have the legal authority to tokenize and sell their work.

(A fundamental shift in how we see and value digital assets has been brought about by NFTs. In the digital sphere, they make new kinds of innovation, ownership, and economic models possible. It will be interesting to watch how different industries are impacted by the NFT arena as it continues to change, as well as how the technology underlying NFTs advances in the years to come.

Institutional Adoption:

Blockchain technology and cryptocurrency institutional adoption is a significant trend that has been gaining traction in recent years. This is a reference to the participation and funding of significant, well-respected financial institutions, businesses, and governmental organizations in the bitcoin and blockchain area. Their involvement shows that these technologies are becoming increasingly recognized as valuable and legitimate elements of the world financial system.

Following are a few crucial elements of institutional adoption:

1.Investment and Asset Allocation:

Hedge funds, family offices, and pension funds are among the institutional investors who have started investing a portion of their portfolios to digital assets like Bitcoin. The possibility for uncorrelated returns and as an inflation buffer are the motivations behind this diversification strategy.

2.Crypto Custody Services:

Specialized crypto custody services have developed in response to the demand for secure storage options for institutional clients. These services offer secure digital asset storage, frequently utilizing cutting-edge security methods and cold storage procedures.

3.Regulatory Compliance:

Compliance with regulations is essential for institutions looking to enter the bitcoin market. Institutional investors can now participate in the cryptocurrency market thanks to the frameworks and rules that have been established by numerous governments and financial regulators.

4.Derivatives and Futures Markets:

There has been an increase in institutional trading in bitcoin derivatives like futures and options. Institutions can control their exposure to digital assets by using these financial instruments’ hedging and risk management capabilities.

5.Blockchain-Based Solutions and Services:

Institutions are looking into using blockchain technology for a range of non-cryptocurrency uses. This covers tools for supply chain management, smart contracts, asset tokenization, and more.

6.Stable-coins and Digital Currencies:

Stablecoins, which are digital currencies tied to the value of conventional fiat currencies, are being investigated for usage by some institutions. Furthermore, central banks are thinking of creating their own digital currencies (CBDCs) for use in transactions.

7.Venture Capital and Investment Funds:

Venture capital firms and institutional investment funds have been aggressively taking part in funding rounds for blockchain and cryptocurrency entrepreneurs. This investment supports the growth and innovation in the industry.

8.Education and Research:

Research groups and academic institutions are devoting more and more funds to studying and comprehending blockchain technology and cryptocurrencies. This entails setting up research facilities, providing educational opportunities, and carrying out analyses of the possible effects of these technologies.

9.Risk Assessment and Due Diligence:

Institutions thoroughly evaluate the risks and do their homework before entering the bitcoin market. This entails assessing elements including ecosystem maturity, security precautions, and regulatory compliance.

10.Impact on Market Dynamics:

Institutional investors can significantly alter market dynamics by affecting liquidity, price stability, and mood of the market as a whole.

11.Mainstream Recognition:

The engagement of trustworthy organizations gives cryptocurrencies and blockchain technology legitimacy and general acceptance. This may promote broader adoption and acceptability among more people.

(An important step in the development of the bitcoin and blockchain industries is institutional adoption. It denotes a change in interest from a narrow group to the general public, possibly opening the door for more widespread adoption and the incorporation of new technologies into the established financial system. However, as institutions make their way through this uncharted territory, there are still issues and regulatory considerations.)

Regulatory Frameworks:

The legal and operational landscape of cryptocurrencies and blockchain technology is greatly influenced by regulatory regimes. They offer a collection of regulations, standards, and guidelines that control how digital assets are used, traded, and issued. To protect consumers, stop financial crimes, and maintain the stability of financial systems, government agencies, financial authorities, and regulatory organizations execute these policies.

Aspects of regulatory frameworks that are crucial in the context of cryptocurrencies and blockchain technology include the following:

1.Definition and Classification of Digital Assets:

To distinguish between cryptocurrencies, security tokens, utility tokens, and other categories of virtual assets, regulatory frameworks seek to identify and classify digital assets. Frequently, these classifications dictate the relevant regulatory requirements.

2.Licensing and Registration Requirements:

Some jurisdictions demand that people and companies engaged in cryptocurrency-related activities, like exchanges, wallets, and ICOs (Initial Coin Offerings), apply for licenses or register with regulatory bodies.

3.Anti-Money Laundering (AML) and Know Your Customer (KYC) Compliance:

Entities dealing with cryptocurrencies are required by AML legislation to put safeguards in place to prevent money laundering and the financing of criminal activities. Verifying users’ and customers’ identities as part of KYC procedures helps to ensure that AML requirements are being followed.

4.Consumer Protection and Investor Safeguards:

Provisions to safeguard consumers and investors from fraud, swindles, and deceptive business activities are frequently included in regulatory frameworks. Setting guidelines for openness, disclosure, and conflict resolution may be necessary.

5.Taxation and Reporting Obligations:

Regulations provide forth procedures for declaring and paying taxes on cryptocurrency-related income, capital gains, and transactions. Cryptocurrency transactions may be taxed.

6.Securities and Exchange Commission (SEC) Oversight:

Tokens that meet the criteria to be considered securities are frequently subject to extra rules that are enforced by securities regulators. This covers the prerequisites for filing, disclosing, and abiding with securities regulations.

7.Data Privacy and Security:

In particular, when personal data is gathered or processed in bitcoin transactions, regulatory frameworks address concerns about data privacy and security.

8.Market Manipulation and Fraud Prevention:

To stop market manipulation, insider trading, and other fraudulent actions in the cryptocurrency market, regulations may contain clauses.

9.Cross-Border Considerations:

Because cryptocurrencies are a global phenomenon, cross-border contacts and transactions must be taken into account in regulatory frameworks. International collaboration and the implementation of regulatory harmonization may be required for this.

10.Innovation and Sandbox Programs:

To allow entrepreneurs and businesses in the blockchain and cryptocurrency area to operate in a controlled environment, stimulating innovation while assuring compliance, some countries create regulatory sandboxes or innovation hubs.

11.Education and Awareness:

The public, companies, and investors may be educated about the dangers, advantages, and legal requirements related to cryptocurrencies and blockchain technology through the use of regulatory frameworks.

12.Adaptability and Future-Readiness:

Because the cryptocurrency and blockchain industries are evolving so quickly, regulatory frameworks must be adaptable and flexible to take into account new technology and business models.

(In order to reconcile innovation with consumer safety and financial stability in the cryptocurrency and blockchain business, regulatory frameworks provide the essential structure and rules. A healthy and responsible ecosystem for digital assets and decentralized technology depends on finding the proper balance.)

Environmental Considerations:

An important topic in the debate over cryptocurrencies and blockchain technology is environmental concerns. The energy-intensive mining process, which is essential to many blockchain networks, especially those implementing the Proof of Work (PoW) consensus method, is the main cause of these technologies’ negative environmental effects.

The following are some essential environmental factors to take into account when using cryptocurrencies and blockchain technology:

1.Energy Consumption:

It takes a lot of processing power to mine cryptocurrencies like Bitcoin, which in turn uses a lot of energy. As a result, there have been questions raised concerning the environmental impact of cryptocurrency networks, especially those that use PoW.

2.Proof of Work vs. Proof of Stake:

Environmental effects of various consensus methods differ. Proof of Stake (PoS) is more energy-efficient since it relies on validators who are selected to create new blocks based on the amount of bitcoin they hold and are prepared to “stake” as collateral, as opposed to Proof of Work, which depends on processing power and electricity.

3.Carbon Emissions:

PoW mining uses a lot of energy, which increases carbon emissions, especially if the electricity is produced using fossil fuels like coal or natural gas.

4.Renewable Energy and Sustainable Mining:

Sustainable mining techniques, such as the utilization of clean energy sources like solar, wind, and hydroelectricity, are the focus of several programs. This can lessen the harm that cryptocurrency mining causes to the environment.

5.Blockchain Sustainability Reports:

By disclosing their energy usage and carbon footprint in sustainability reports, certain blockchain initiatives and networks show accountability and transparency in tackling environmental issues.

6.Eco-Friendly Blockchain Networks:

Some more recent blockchain networks were built with energy conservation in mind. To save energy, they employ Proof of Stake, Delegated Proof of Stake (DPoS), or other alternatives as alternate consensus techniques.

7.Research and Innovation:

The goal of ongoing blockchain technology research and innovation is to create consensus processes and protocols that use less energy. Investigating alternative methods like Proof of Authority (PoA) and Proof of Space (PoSpace) is part of this.

8.Carbon Offsetting and Environmental Initiatives:

Some blockchain initiatives and businesses are looking into ways to engage in green projects like reforestation or renewable energy projects in order to reduce their carbon footprint.

9.Community-Led Initiatives:

Environmental concerns are being actively addressed by cryptocurrency initiatives and communities. This covers conversations about network upgrades, modifications to the consensus-building process, and neighborhood-based initiatives to advance sustainability.

10.Regulatory Considerations:

Regulatory issues involving cryptocurrency and blockchain technology may be influenced by environmental considerations. To lessen the negative effects of cryptocurrency mining on the environment, some governments may enact legislation.

11.Public Awareness and Education:

It is essential to educate the public about the negative effects that cryptocurrencies and blockchain technology have on the environment. Users, investors, and stakeholders can make wise decisions and adopt ethical behaviors by being more informed.

(It is difficult to balance the potential advantages of cryptocurrencies and blockchain technology with those technologies’ negative effects on the environment. It is the goal of ongoing study, innovation, and community-driven activities to allay these worries and advance sustainable business practices in the sector.)

Cross-Border Transactions and Remittances:

Remittances and cross-border transactions are essential elements of the global economy. They entail the transfer of funds over international borders for a variety of uses, including trading, investing, and providing for one’s own financial needs. Banks and intermediaries are frequently used in traditional methods of executing cross-border transactions, which can be time-consuming and expensive. To expedite and improve the effectiveness of cross-border transactions, however, cutting-edge solutions have been developed with the rise of cryptocurrencies and blockchain technology.

In the context of cryptocurrencies and blockchain technology, the following are some crucial elements of cross-border transactions and remittances:

1.Cost Efficiency:

Blockchain technology and cryptocurrencies have the potential to drastically lower the cost of international transactions. Users can transfer and receive money for less money by doing away with middlemen and their fees.

2.Speed of Transactions:

Compared to traditional banking systems, which may entail numerous intermediary banks and settlement processes, blockchain-based cross-border transactions can be carried out significantly more quickly.

3.24/7 Availability:

Blockchain networks are always-on, enabling users to execute international transactions whenever they choose, outside of banking hours or official holidays.

4.Financial Inclusion:

For people in areas with limited or no access to traditional banking systems, cryptocurrency and blockchain technology can offer access to financial services. This is crucial for beneficiaries of remittances in developing nations.

5.Reduced Currency Conversion Costs:

Using cryptocurrencies can make it unnecessary to convert currencies several times when making international purchases. Exchange rates and conversion costs may be reduced as a result.

6.Security and Transparency:

Blockchain technology offers a safe and open ledger for keeping track of transactions. A transaction that has been recorded on the blockchain is unchangeable and open to anyone’s verification, offering a high level of security.

7.Regulatory Compliance and KYC/AML:

To ensure compliance with legal requirements, certain blockchain-based platforms and services for international trade include Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures.

8.Privacy Considerations:

Users in cross-border transactions may have varied levels of privacy depending on the blockchain and platform being used. While some blockchains place a higher priority on privacy measures, others are more open.

9.Volatility Management:

Since cryptocurrencies can be unstable, there may be some risk involved in international transactions. A way to lessen this volatility is to use stablecoins, which are digital currencies whose value is tied to that of a fiat currency.

10.Remittances and Personal Transfers:

Innovative remittance systems made possible by blockchain technology allow people to transmit money across borders more quickly and inexpensively than they could before.

11.International Trade and Commerce:

Blockchain-based solutions for cross-border transactions might be advantageous for businesses engaged in international trade since they provide speedier settlement times and lower transaction costs.

12.Smart Contracts for Trade Finance:

Aspects of trade finance, such letters of credit and supply chain financing, can be automated on blockchain systems, expediting international trade procedures.

(A major advancement in the financial sector is the use of cryptocurrencies and blockchain technology for remittances and cross-border transactions. Even while there are still issues like volatility and regulatory concerns, this industry’s continuing innovation and adoption might completely alter how money is transmitted across international borders.)

Conclusion:

The future of finance is poised to be significantly influenced by cryptocurrencies. The trends mentioned above show how this industry is dynamic and quickly changing. Cryptocurrencies have the ability to change financial systems, empower people, and open up new economic opportunities on a global scale as innovation continues and regulatory frameworks develop. For individuals and institutions trying to navigate the fascinating and disruptive world of cryptocurrencies and finance, staying educated and taking an active interest in these trends will be essential.

10 most popular cryptocurrencies:

Bitcoin (BTC):

The first and most well-known cryptocurrency is called Bitcoin. It was conceived and published in a whitepaper in 2008 by an unidentified person or group of persons going by the pseudonym Satoshi Nakamoto. In addition to being utilized as a store of wealth and a medium of exchange, bitcoin is frequently referred to as “digital gold.”

Ethereum (ETH):

Developers can create and implement smart contracts and decentralized apps (DApps) on the decentralized Ethereum platform. Vitalik Buterin made the suggestion, and it became operational in 2015. The native cryptocurrency of the Ethereum platform is called ETH.

Binance Coin (BNB):

The native cryptocurrency of one of the biggest cryptocurrency exchanges in the world, Binance, is called Binance Coin. BNB can be used for many different things inside the Binance ecosystem in addition to paying transaction fees on the platform.

Cardano (ADA):

A blockchain platform called Cardano is intended for the creation of DApps and smart contracts. It attempts to give decentralized apps a more stable and scalable foundation. The Cardano platform’s native coin is called ADA.

Solana (SOL):

High-performance blockchain platform Solana is renowned for its quick transaction times and inexpensive transaction costs. It seeks to assist DeFi projects and decentralized apps. The Solana network’s native coin is called SOL.

XRP (XRP):

The Ripple network’s native coin is called XRP. The goal of ripple is to make cross-border payments quick and affordable. International transactions are settled using it by financial institutions and payment service providers.

Polkadot (DOT):

Polkadot is a multi-chain blockchain technology that enables different blockchains to interoperate and share information. It is built to accommodate a variety of services and applications. The Polkadot network’s native coin is called DOT.

Dogecoin (DOGE):

Dogecoin was once a meme cryptocurrency but has since grown in acceptance and appeal as a type of virtual money. It is popular for minor purchases and tips and is recognized by its Shiba Inu dog emblem.

Avalanche (AVAX):

Avalanche is a blockchain technology that seeks to give decentralized applications great throughput and scalability. It enables the establishment of unique blockchains. The Avalanche network’s native coin is called AVAX.

Chainlink (LINK):

A decentralized oracle network called Chainlink links smart contracts with actual data. It makes it possible for smart contracts to safely communicate with other resources such as external APIs and data feeds. The Chainlink network’s native coin is called LINK.

Check here realtime crypto prices: https://www.investing.com/crypto/

That’s for now about Cryptocurrency and the Future of Finance: Trends to Watch. Thanks for reading at our website. If you find some changes in above researched information then please don’t hesitate to reach out at: thehappeningworld44@gmail.com

If you like this article, please share it and you can also suggest us about more topics that we can cover in our upcoming articles at our website.

See you again, Thanks!!!